Every successful commercial real estate investor understands this truth: **You make your money in the buy—**but you keep it in the exit.

Yet, knowing when to execute that exit strategy can be one of the most difficult decisions in your investment journey.

As a broker, advisor and investor who partners with investors across Washington, DC, Maryland, Virginia, Georgia, and select global markets, I’ve seen the difference that timing can make. Exiting too early may limit your upside. Exiting too late can erode your returns. The key is recognizing the signals—both in your asset and in the market.

Below are the major indicators every investor should evaluate when determining the right moment to sell, refinance, or reposition a commercial asset.

1. You Have Achieved (or Surpassed) Your Target Investment Metrics

You should always enter a deal with defined financial goals—IRR, cash-on-cash return, equity multiple, holding period, and value-add execution milestones.

If your property has met or exceeded those targets, it may be time to consider an exit.

Key questions to ask:

-

Have you achieved your projected IRR ahead of schedule?

-

Has stabilized NOI reached the level required to maximize value upon sale?

-

Is your equity multiple at or above your desired threshold?

If the financial performance has already delivered the returns you projected in year five by year three, for example—holding longer may expose you to unnecessary market risk.

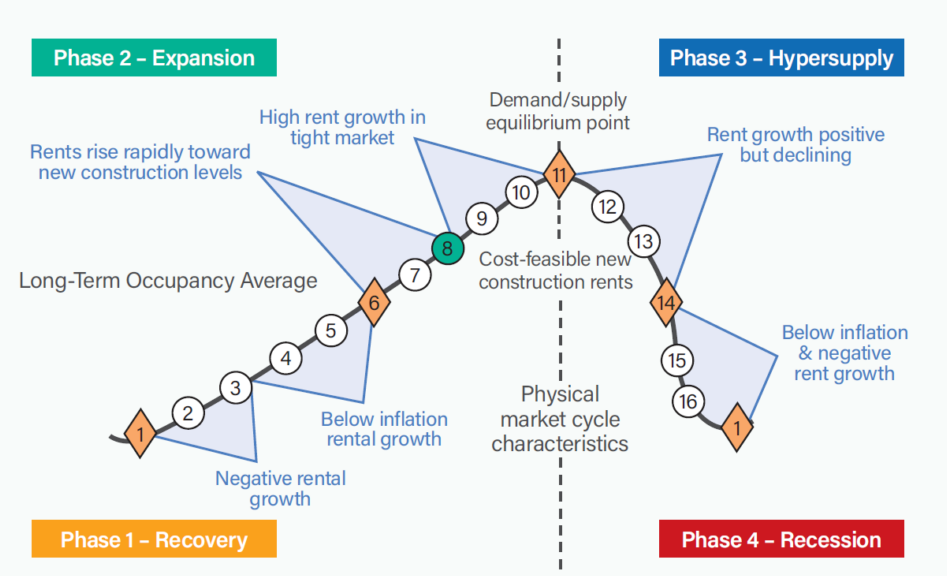

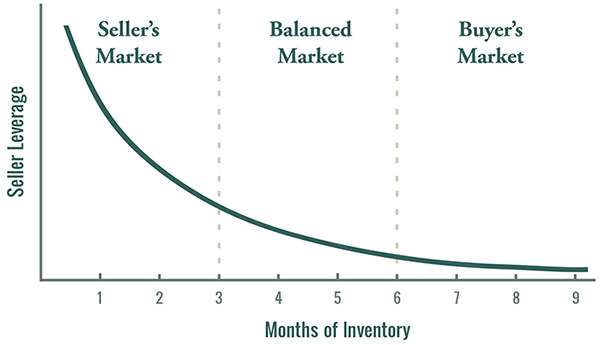

2. Market Conditions Are Favorable (or Shifting Against You)

Your exit strategy isn't just about property performance—it’s about macro and micro market timing.

Favorable conditions that support an exit:

-

Low cap rate environment (maximizing sale price)

-

High investor demand in your asset class (multifamily, mixed-use, retail, etc.)

-

Compression in interest rates making financing cheaper for buyers

-

Strong rent growth or demographic shifts raising asset values

Warning signs that the window may start closing:

-

Rising vacancy in your submarket

-

Economic softening, job losses, or industry shifts

-

Increasing inventory or new construction competition

-

Rising interest rates that reduce buyer purchasing power

Investors who wait for the “perfect” market often miss their peak. Smart investors watch the cycle—and act while demand is still strong.

3. Your Value-Add Plan Is Complete

Many investors purchase assets with a clear business plan—renovations, repositioning, lease-ups, management overhaul, or operational improvements.

When that plan is fully executed, the property is often at its maximum resale value.

Signs your value-add cycle is complete:

-

Units are fully renovated and achieving premium rents

-

Stabilized occupancy has been maintained 90–95%+

-

Operating expenses have been optimized

-

Cash flow has plateaued at its highest expected level

At this stage, the building has transformed into an attractive, performing, turnkey asset—highly desirable to institutional buyers, 1031 exchange investors, and private equity groups.

4. Your Capital Is Better Deployed Elsewhere

This is one of the most overlooked—but most strategic—reasons to exit.

If your equity trapped in the asset could earn significantly higher returns in another investment, it may be time to sell or refinance.

Consider an exit when:

-

A stronger, higher-yield deal is available (larger unit count, stronger submarket, distressed opportunity).

-

You want to consolidate your portfolio or scale into institutional-grade assets.

-

You're repositioning your investment strategy—moving into new markets, shifting asset classes, or diversifying globally.

Opportunity cost is real. Commercial real estate investors grow fastest when they redeploy capital strategically—not emotionally.

5. You Are Approaching Key Milestones in the Debt Structure

Debt terms often influence exit timing.

Strategic times to reassess your exit:

-

Approaching a balloon payment

-

Nearing the end of a fixed-rate period

-

Facing large capital expenditures or system end-of-life requirements

-

A lender has tightened DSCR or reserve requirements

Investors frequently maximize returns by selling before major debt changes impact the building’s performance or financing costs.

6. Personal or Portfolio Goals Have Shifted

Sometimes the market isn’t the reason—your life is.

It may be time to execute your exit strategy if:

-

You want to reduce management responsibilities

-

You’re preparing for retirement or lifestyle changes

-

You’re transitioning from active investing into syndications or passive income

-

You need liquidity for another business (luxury brand, global venture, etc.)

Your commercial real estate should serve your overall vision—not the other way around.

7. The Property’s Performance Has Peaked (or Is Declining)

If cash flow is stagnating, operational expenses are rising, or the building requires substantial capital improvements, holding the property may reduce your long-term returns.

Time to consider an exit if:

-

Deferred maintenance is building up

-

Tenant quality or demand is shifting

-

CapEx needs outweigh projected future returns

-

Competition is increasing in your submarket

Selling before a performance decline preserves your equity and positions you for your next investment.

So, When Is the Right Time to Exit?

There is no universal formula, but sophisticated investors rely on a combination of:

-

Market timing

-

Property performance metrics

-

Debt structure analysis

-

Portfolio strategy

-

Long-term financial goals

Most importantly—they make decisions based on data, not emotion.

Your exit strategy should be defined before you acquire the property, monitored throughout the hold period, and executed when conditions align with your investment thesis.

Thinking About Exiting a Commercial Investment?

I advise investors every day on how to maximize value, minimize tax impact, and strategically position their assets for sale.

If you're considering a sale, refinance, recapitalization, or partnership restructure, I can help you determine whether now is the right time.

Let’s schedule a confidential strategy session.

Visit SonyaAbney.com or contact me directly.

REALTOR ®

Washington, DC Office

Cosmopolitan Properties

Real Estate Brokerage

600 Massachusetts Ave NW, Suite 250

Washington, DC 20001

DC Office: (202) 387 0777

Atlanta, GA Office

Keller Williams Realty

Atlanta Perimeter

115 Perimeter Center Pl NE, Suite 100

Atlanta, GA 30346

GA Office: (678) 298 1600